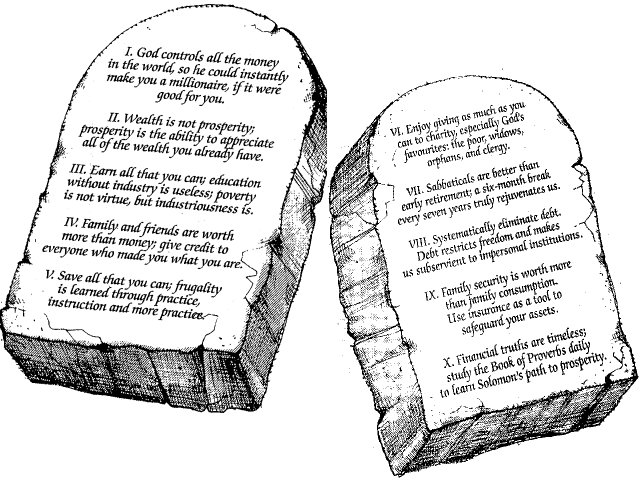

The Ten Commandments of personal finance

- Details

- Created: Wednesday, 01 November 2000 15:57

- Written by Tom Lipp

In the classic Christmas tale The Gift of the Magi, by short-story writer O. Henry, an impoverished young husband struggles with the problem of what to buy his wife for Christmas, and his poor young wife, what to buy her husband.

In the classic Christmas tale The Gift of the Magi, by short-story writer O. Henry, an impoverished young husband struggles with the problem of what to buy his wife for Christmas, and his poor young wife, what to buy her husband.

On Christmas Eve, the young man sells his grandfather’s prized pocket watch to but an expensive comb for his wife’s hair. His wife cuts off and sells her long, luxurious hair, to buy a watch-fob for her husband’s watch. And on Christmas morning, staring dumbfounded at their now-useless gifts, they discover the depth of their love for each other.

For Christian financial planner Tom Lipp, that sort of giving is a sign of the true spirit of Christmas and a genuinely Christian understanding of prosperity.

“I’ve run into people so upset with the holiday shopping frenzy, they’ve just going to stop giving,” said Lipp.

“And I say, whoa! The whole meaning of Christmas is giving. But you have to understand where giving fits in the bigger picture of real prosperity,”

With his wife, Priscilla, Lipp has discovered some helpful hints for keeping Christ in Christmas for their seven kids.

Hints like:

- Make your first gift to someone less fortunate outside your family, and continue to give to the needy throughout the season;

- Take whatever money you can afford for gift-giving out of the bank, pay cash and spend only what you have;

- Draw names from a hat, so rather than everyone giving thoughtlessly to everyone, each person can give a few, well-thought-out gifts;

- On Christmas Day, take turns opening the gifts under the tree, so that each one can be appreciated.

The Christmas buying-frenzy is not simply an effect of “consumerism” or seasonal advertising campaigns, Lipp argues. It happens because people forget − year round − the real purpose of wealth and the nature of prosperity.

Lipp, MBA, CMA, a financial planner licensed by Portfolio Strategies Corp., believes that western culture has shifted from a Christian to a pagan understanding of personal finances.

Even Christians no longer see the difference between wealth and prosperity. So he has spent eleven years, trying to teach his clients the Ten Commandments of Personal Finance.

“Prosperity is wealth plus the ability to enjoy it,” he said.

“If we aim toward prosperity rather than wealth, we begin to emphasize using our money better, rather than simply getting more of it. Giving is an essential part of the better.”

One of Lipp’s clients was a single woman in her mid-50s, with a good income and healthy investment portfolio. However, when he asked her,”what are your personal goals?” she answered, “I live for my cat.”

For 18 months, Lipp tried to interest this client in a charity, until finally she agreed to give $15 per month to a family in India. The woman remained unconvinced, however, until she received a letter and family picture from the widow and four children she is now supporting.

“She called me up in tears,” he remembered.

“For the first time, somebody else was depending on her. For $15 a month, she found a whole new purpose in life, giving to those in need.

“She couldn’t stop crying. She said I’d showed her a new approach to personal finances. I just said, well, it’s actually 4,000 years old. The great truths are too important to be new.”

The goal of Christian financial planning is not independence, but rather a healthy interdependence, Lipp said. The pursuit of financial independence is not only futile’ it’s unhealthy.

He tried to work with a Calgary couple with a portfolio of over $1million. Yet the husband would resist purchasing new tires for his wife’s minivan; he searched instead for used or retreaded tires in the classified ads. So every time the wife drove down the icy road, to their acreage, she wondered whether her husband loved her.

Lipp couldn’t work with the couple. The husband’s desire for more money exceeded his willingness to make better use of his money.

A number of features distinguish Christian financial planning from the pagan version, Lipp said.

First, the Christian recognizes the authority of God in all issues, including financial ones. God can give us all we need, without resorting to money. And if he has us work for it instead, it’s because he knows what is good for us.

“The world’s version of financial success is winning the lottery,” Lipp said.

“But I don’t know anyone, in the end who was made happy by fast money.”

Second, the pagan perspective on time, limited to this life, is summed up in a bumper-sticker: The Person Who Dies With The Most Toys, Wins. The Christian, in contrast, puts worldly wealth in the context of eternity. So charity becomes an opportunity for truly long-term planning.

Third, Christian financial planning recognizes the centrality of family time, in both the uses of wealthy and the sacrifice of working time for family time.

“I worked with a young couple who’d just had their first child,” Lipp said.

“The husband was working at two jobs. His wife was saying, I need you at home, and he was saying, I can’t afford that. He was pulling in $80,000 a year and he thought he couldn’t afford to take time with his wife and baby.

“I had to convince him that he couldn’t afford NOT to spend time with his wife and baby.”

Fourth, when it comes to children, Christian parents must be concerned less with entertaining their children, and more with developing their children, and more with developing their characters. Children will never grow industrious and frugal themselves, it they have everything given to them.

Fifth, Lipp said, wealth must be used to fight “age segregation.” Rather than warehousing seniors, families must be prepared to bring them into the home, first, because it’s good for children to grow up with ole people, and second, because soon there’ll be no other moral choice.

“Twenty years from now, it’s going to get real ugly out there,” he said.

“If the Canada Pension Plan collapses, there’ll be lots of seniors who can’t afford their homes. Young taxpayers, raised in day cares, aren’t going to want to foot the bill for extended care facilities. So there’ll be a big push for euthanasia, and the only seniors who’ll be safe are the ones whose families take them in.”

Whatever happens, however, Lipp trusts that the truths of the Judeo-Christian work ethic will hold true.

Most people enjoy their work, he believes, but they may not realize why. Work is essentially serving others. It brings in money − and that’s important − but it’s enjoyable.

Likewise, charity is central to the happiness of anyone grateful to God for life itself.

“Generosity is not a function of your income; it’s a predisposition of your heart,” Lipp said. “There are those who can’t work. They need our charity. It makes us happy to give to them, and as the Bible says, the generous man will prosper.

“For those who could work but won’t, remember the words of the apostle Paul to the Thessalonians: he who does not work, let him not eat.